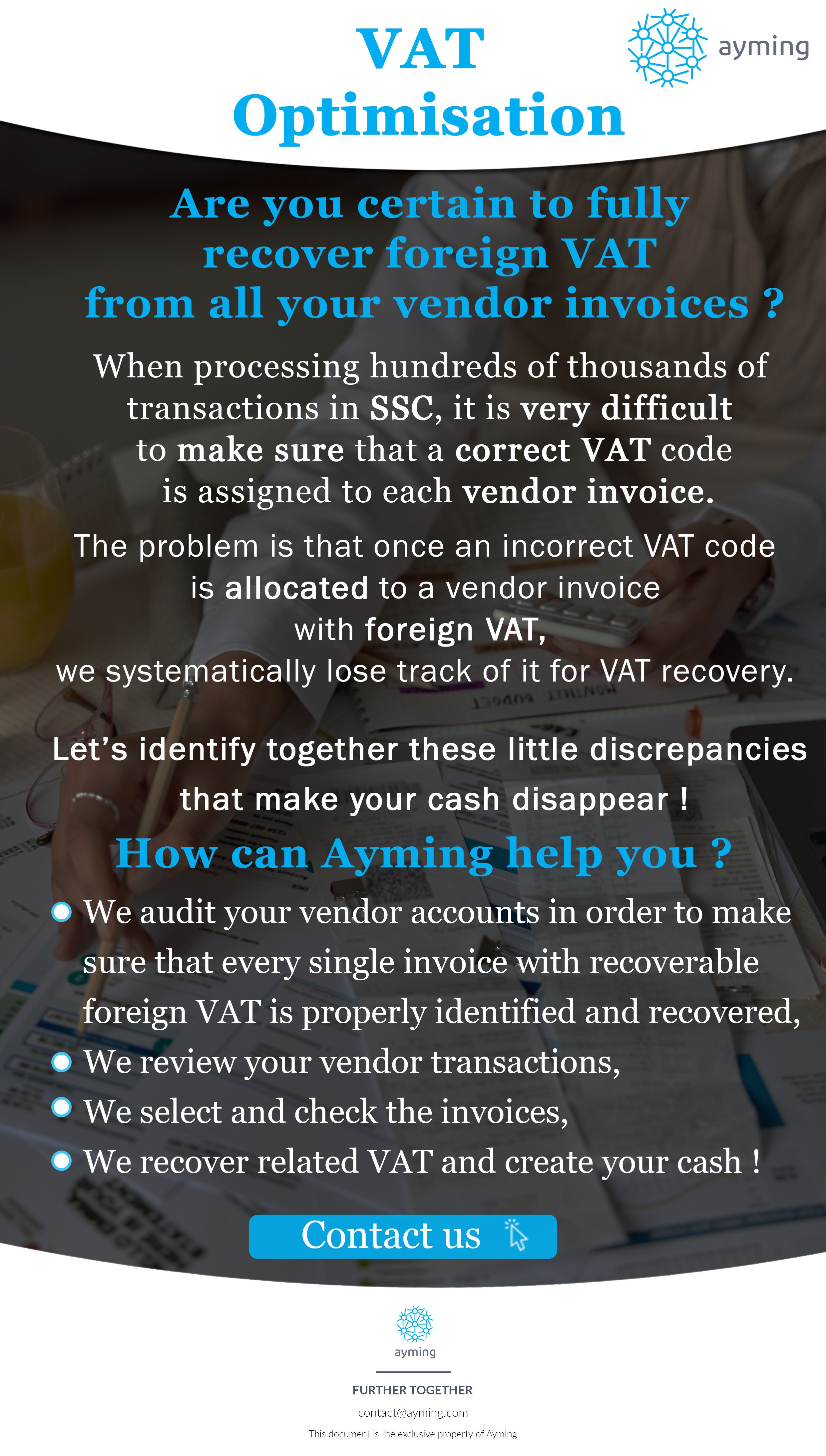

When processing hundreds of thousands of transactions in SSC, it is very difficult to make sure that a correct VAT code is assigned to each vendor invoice.

The problem is that once an incorrect VAT code is allocated to a vendor invoice with foreign VAT, we systematically lose track of it for VAT recovery.

So, are you certain to fully recover foreign VAT from all your vendor invoices ? Our experts Ayming can help you in your projects !

Discover below our infographic to know how recover foreign VAT :

Discover our other infographics to have a complete vision of this reform and its effects:

UE Businesses : VAT recovery outside UE

Non-UE Businesses: VAT recovery inside UE

UE Businesses: Foreign VAT recovery inside UE

UK 13th Directive : To be done before 31st December – Recover UK VAT

Contact our experts