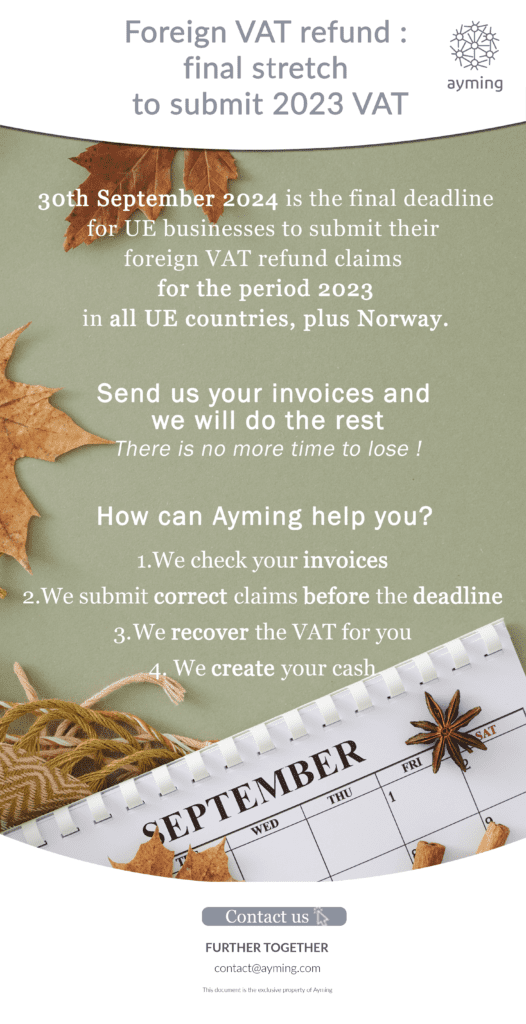

30th September 2024 is the final deadline for UE businesses to submit their foreign VAT refund claims for the period 2023 in all UE countries, plus Norway.

Ayming can get your VAT back for you. Discover how below the infographic:

Discover our other infographics to have a complete vision of this reform and its effects:

UE Businesses : VAT recovery outside UE

Non-UE Businesses: VAT recovery inside UE

UE Businesses: Foreign VAT recovery inside UE

UK 13th Directive : To be done before 31st December – Recover UK VAT

Olympic and Paralympics Games Paris 2024 – Mind the VAT

Contact our experts